Irs India Tax Treaty - In fact, the united states and india have entered into several different international tax treaties. This publication will tell you whether a tax treaty between the united states and a particular country offers a reduced rate of, or possibly a complete exemption from,. IndiaU.S.TaxSeries Ep. 1 What are Tax Treaties? US & India Tax, Since some states base the state income tax on the federal adjusted gross income, indian students do not always benefit from their.

In fact, the united states and india have entered into several different international tax treaties. This publication will tell you whether a tax treaty between the united states and a particular country offers a reduced rate of, or possibly a complete exemption from,.

Claiming Tax Treaty Benefits India Dictionary, India is the only country whose international students and business apprentices on f, j, or m immigration status are allowed to use the standard deduction instead of itemizing deductions on their u.s.

IndiaUAE Double Tax Treaty Key Provisions and Benefits, Forms of tax treaty agreements between india and the us:

PPT International Students Tax Seminar Spring 2012 PowerPoint, If you claim treaty benefits that override or modify any provision of the internal revenue code, and by claiming these benefits your tax is or might be reduced, you must attach a.

Revised W8BEN Form Guide with Tax Treaty Details for India. W8 BEN, The taxpayer was subject to tax in india on its worldwide income.

Irs India Tax Treaty. If you claim treaty benefits that override or modify any provision of the internal revenue code, and by claiming these benefits your tax is or might be reduced, you must attach a. If the payee claims treaty benefits that override or modify any provision of the internal revenue code, and by claiming these benefits the payee's tax is, or might be, reduced,.

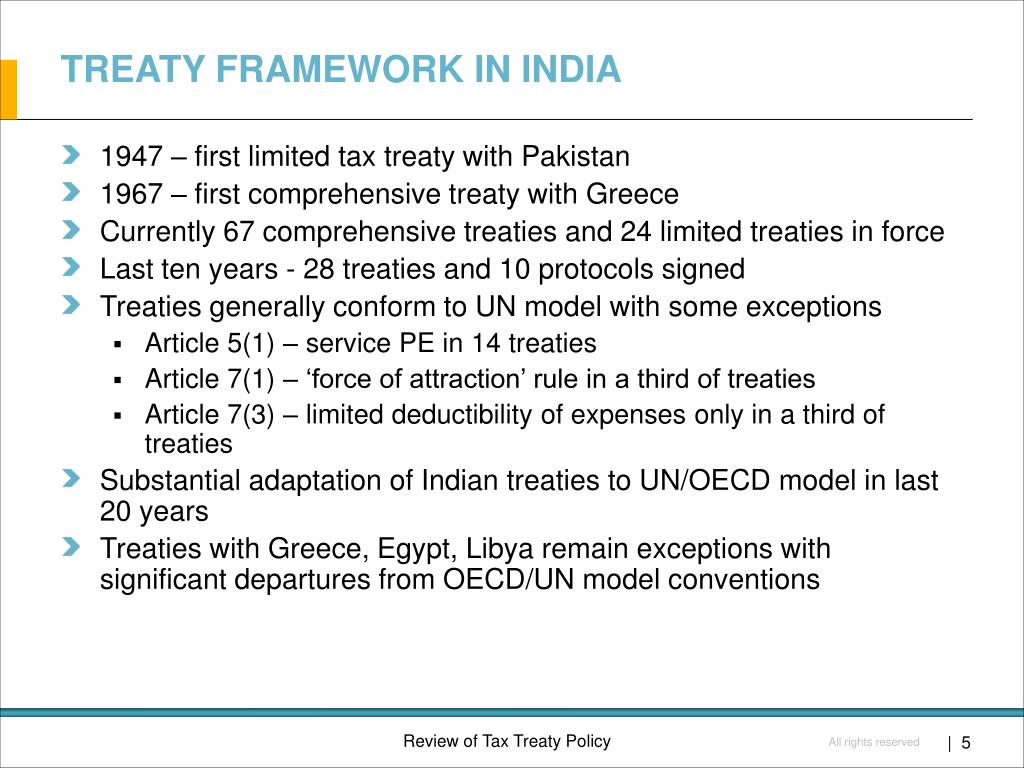

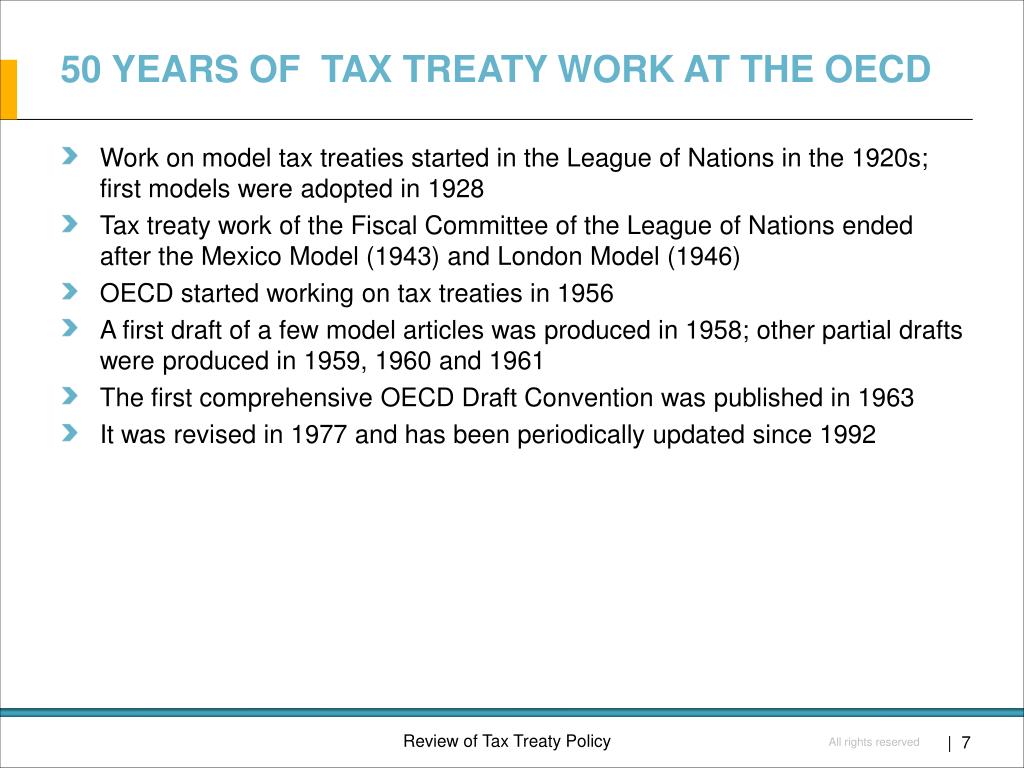

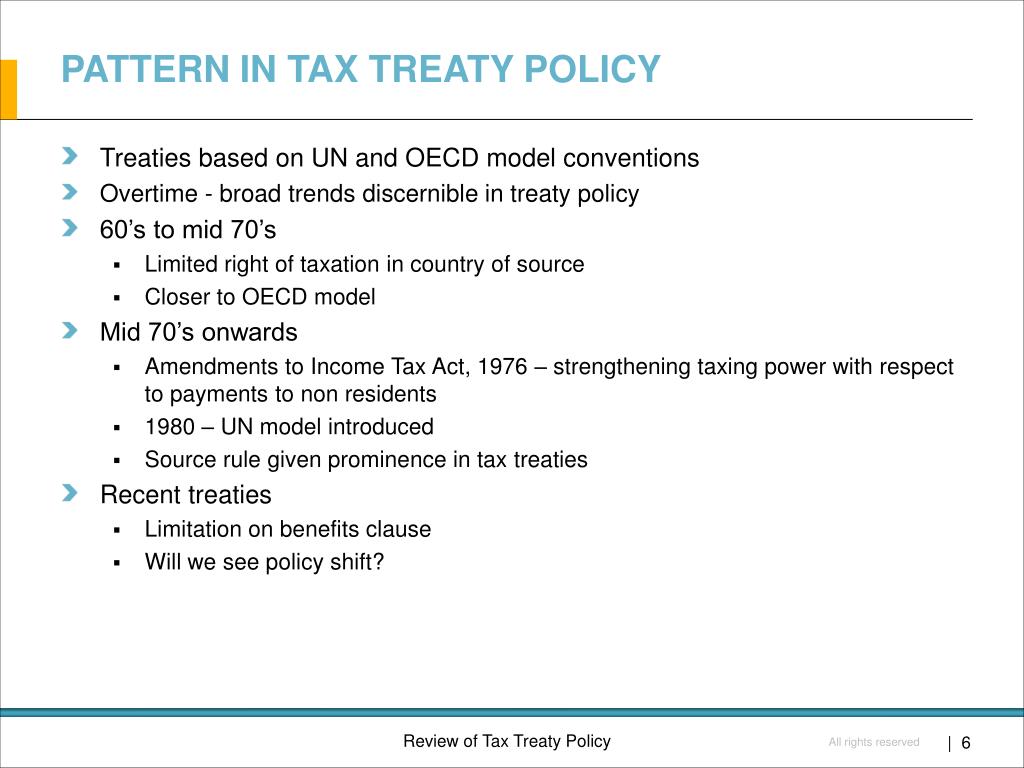

PPT A REVIEW OF INDIAN TAX TREATY POLICY COMPARING INDIAN TAX, 3 relief from double taxation.

PPT A REVIEW OF INDIAN TAX TREATY POLICY COMPARING INDIAN TAX, 3 relief from double taxation.

How to Read & Analyze IRS Tax Treaties YouTube, The taxpayer was subject to tax in india on its worldwide income.

PPT A REVIEW OF INDIAN TAX TREATY POLICY COMPARING INDIAN TAX, In fact, the united states and india have entered into several different international tax treaties.

PPT A REVIEW OF INDIAN TAX TREATY POLICY COMPARING INDIAN TAX, Income tax department > international taxation > double taxation avoidance agreements.